The Bureau of Labor Statistics (BLS) released its monthly Current Employment Statistics (CES) report and Current Population Survey (CPS) for March 2023 on Friday, April 7th. The monthly change in employment given by the CES and the unemployment rate from the CPS are seen as the standard gauges for assessing the health of the U.S. labor market.

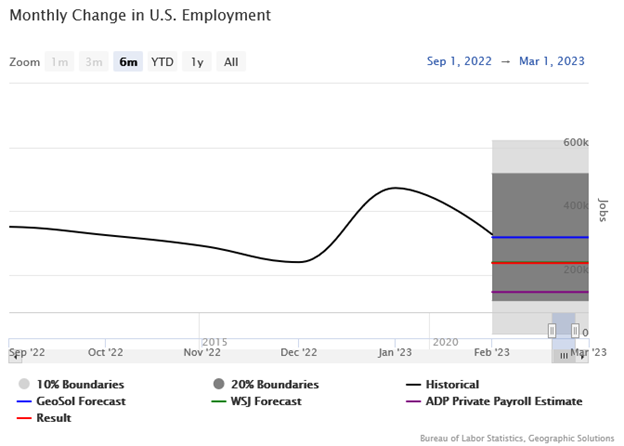

Employment in the U.S. rose by 236,000 jobs. The jobs results were below the Geographic Solutions, Inc. forecast of 317,000 but in line with the WSJ forecast of 238,000. This is the second consecutive month that job growth has slowed which may signal that employment has returned to the slowing pattern it had established throughout the second half of 2022. Geographic Solutions, Inc. derives its employment forecast from internal data on the number of job searchers, job applications, job severances, and applications for unemployment benefits filed on Geographic Solutions state client sites. The forecast uses unemployment claims data from the U.S. Department of Labor (USDOL).

The unemployment rate declined slightly to 3.5%, matching the WSJ estimate. The Geographic Solutions forecast had anticipated an uptick to 3.7%. The unemployment rate forecast uses internal data on the number of job openings, unemployment applications, and job severances on Geographic Solutions state client sites. The forecast uses unemployment claims data from the USDOL.

Job creation was strongest in Leisure & Hospitality (72,000) and Education & Health Services (65,000). Other major contributors to employment were Professional & Business Services and the Government sectors. Construction shed 9,000 jobs. Other industries were flat.

Leisure & Hospitality and Government are the only major sectors to remain below their pre-pandemic employment levels.

The labor force participation rate increased to 62.6% from the previous month. The more expansive U-6 unemployment rate counts discouraged workers who are no longer actively seeking work (and therefore no longer in the labor force) and those that have settled for part-time employment but desire a full-time job. This measure of unemployment declined to 6.7%.

The March Labor Market Report shows that job growth has slowed. Although fewer, the representation remained a solid expansion, with an increase in the labor force participation rate. Furthermore, year-over-year private sector wage gains increased at the lowest rate since June 2021, an encouraging sign that the inflation rate remains on a downward trajectory. However, the surveys for the report were conducted in early March, and do not reflect the recent turmoil in the banking system. This may have future ramifications for jobs and unemployment based on a mix of reactions from the Federal Reserve, the U.S Treasury Department, and employers.